Stock Market Analysis

Stock Market Analysis:

In this portfolio project we will be looking at data from the stock market, particularly some technology stocks. We will use pandas to get stock information, visualize different aspects of it, and finally we will look at a few ways of analyzing the risk of a stock, based on its previous performance history. We will also be predicting future stock prices through a Monte Carlo method!

We’ll be answering the following questions along the way:

- What was the change in price of the stock over time?

- What was the daily return of the stock on average?

- What was the moving average of the various stocks?

- What was the correlation between different stocks’ closing prices?

- What was the correlation between different stocks’ daily returns?

- How much value do we put at risk by investing in a particular stock?

- How can we attempt to predict future stock behavior?

Let’s creat a list and call it tech_list

tech_list = ["AAPL","GOOG","MSFT","AMZN","TSLA"]

end = datetime.now()

start = datetime(end.year-1,end.month,end.day)

for stock in tech_list:

globals()[stock]=pdr.DataReader(stock,"yahoo",start,end)

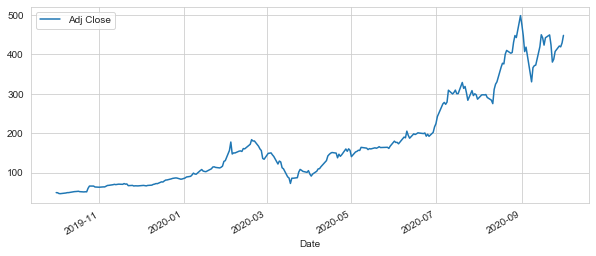

TSLA

| High | Low | Open | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2019-10-01 | 49.189999 | 47.826000 | 48.299999 | 48.938000 | 30813000.0 | 48.938000 |

| 2019-10-02 | 48.930000 | 47.886002 | 48.658001 | 48.625999 | 28157000.0 | 48.625999 |

| 2019-10-03 | 46.896000 | 44.855999 | 46.372002 | 46.605999 | 75422500.0 | 46.605999 |

| 2019-10-04 | 46.956001 | 45.613998 | 46.321999 | 46.285999 | 39975000.0 | 46.285999 |

| 2019-10-07 | 47.712002 | 45.709999 | 45.959999 | 47.543999 | 40321000.0 | 47.543999 |

| ... | ... | ... | ... | ... | ... | ... |

| 2020-09-25 | 408.730011 | 391.299988 | 393.470001 | 407.339996 | 67208500.0 | 407.339996 |

| 2020-09-28 | 428.079987 | 415.549988 | 424.619995 | 421.200012 | 49719600.0 | 421.200012 |

| 2020-09-29 | 428.500000 | 411.600006 | 416.000000 | 419.070007 | 50219300.0 | 419.070007 |

| 2020-09-30 | 433.929993 | 420.470001 | 421.320007 | 429.010010 | 48145600.0 | 429.010010 |

| 2020-10-01 | 448.880005 | 434.420013 | 440.760010 | 448.160004 | 50413600.0 | 448.160004 |

254 rows × 6 columns

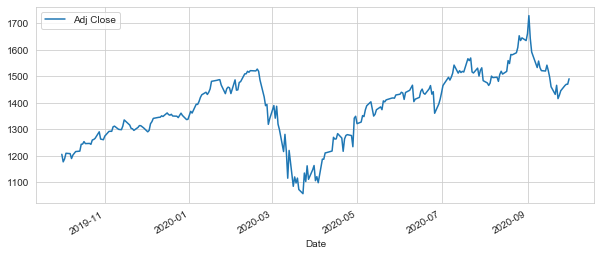

TSLA["Adj Close"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced31a6888>

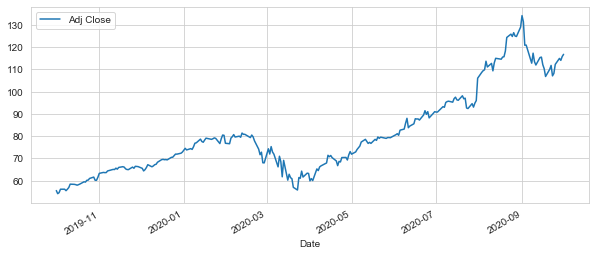

AAPL["Adj Close"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced3168c08>

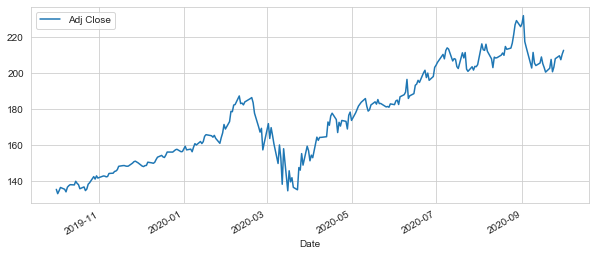

MSFT["Adj Close"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced30c4748>

GOOG["Adj Close"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced300d988>

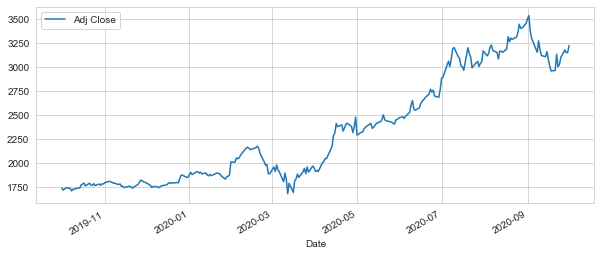

AMZN["Adj Close"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced32efe48>

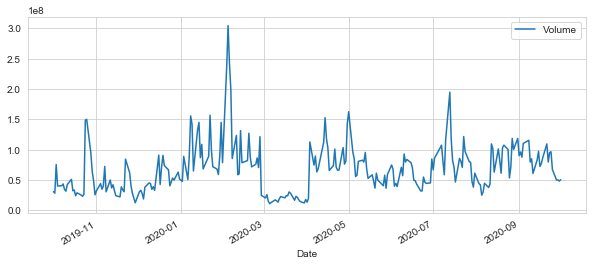

TSLA["Volume"].plot(legend=True, figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced3388948>

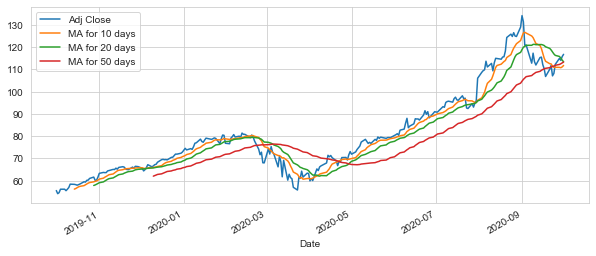

ma_day =[10,20,50]

for ma in ma_day:

column_name = "MA for %s days" %(str(ma))

AAPL[column_name]=AAPL["Adj Close"].rolling(ma).mean()

AAPL[["Adj Close","MA for 10 days","MA for 20 days","MA for 50 days"]].plot(subplots=False,figsize=(10,4))

<matplotlib.axes._subplots.AxesSubplot at 0x1ced3647f08>

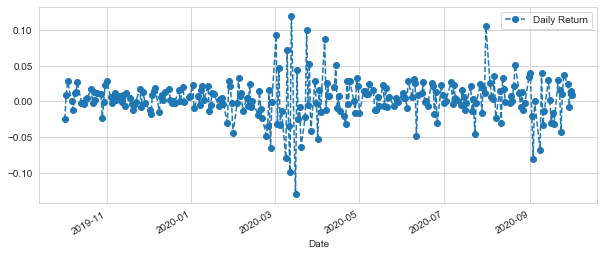

Section 2 - Daily Return Analysis

We’re now going to analyze the risk of the stock. In order to do so we’ll need to take a closer look at the daily changes of the stock, and not just its absolute value. Let’s go ahead and use pandas to retrieve teh daily returns for the Apple stock.

AAPL["Daily Return"] = AAPL["Adj Close"].pct_change()

AAPL["Daily Return"].plot(figsize=(10,4),legend=True,linestyle="--",marker="o")

<matplotlib.axes._subplots.AxesSubplot at 0x1ced397ebc8>

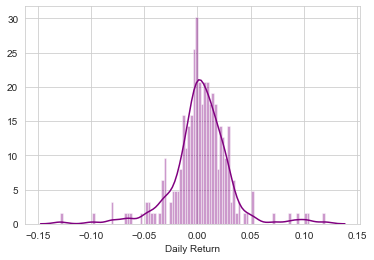

sns.distplot(AAPL['Daily Return'].dropna(),bins=100,color='purple')

<matplotlib.axes._subplots.AxesSubplot at 0x1ced39f01c8>

Now what if we wanted to analyze the returns of all the stocks in our list? Let’s go ahead and build a DataFrame with all the [‘Close’] columns for each of the stocks dataframes.

closing_df=pdr.DataReader(tech_list,"yahoo",start,end)["Adj Close"]

closing_df

| Symbols | AAPL | GOOG | MSFT | AMZN | TSLA |

|---|---|---|---|---|---|

| Date | |||||

| 2019-10-01 | 55.595886 | 1205.099976 | 135.527100 | 1735.650024 | 48.938000 |

| 2019-10-02 | 54.202213 | 1176.630005 | 133.134323 | 1713.229980 | 48.625999 |

| 2019-10-03 | 54.662643 | 1187.829956 | 134.745972 | 1724.420044 | 46.605999 |

| 2019-10-04 | 56.194942 | 1209.000000 | 136.565262 | 1739.650024 | 46.285999 |

| 2019-10-07 | 56.207317 | 1207.680054 | 135.576523 | 1732.660034 | 47.543999 |

| ... | ... | ... | ... | ... | ... |

| 2020-09-25 | 112.279999 | 1444.959961 | 207.820007 | 3095.129883 | 407.339996 |

| 2020-09-28 | 114.959999 | 1464.520020 | 209.440002 | 3174.050049 | 421.200012 |

| 2020-09-29 | 114.089996 | 1469.329956 | 207.259995 | 3144.879883 | 419.070007 |

| 2020-09-30 | 115.809998 | 1469.599976 | 210.330002 | 3148.729980 | 429.010010 |

| 2020-10-01 | 116.790001 | 1490.089966 | 212.460007 | 3221.260010 | 448.160004 |

254 rows × 5 columns

Now that we have all the closing prices, let’s go ahead and get the daily return for all the stocks, like we did for the Apple stock.

tech_rets=closing_df.pct_change()

tech_rets

| Symbols | AAPL | GOOG | MSFT | AMZN | TSLA |

|---|---|---|---|---|---|

| Date | |||||

| 2019-10-01 | NaN | NaN | NaN | NaN | NaN |

| 2019-10-02 | -0.025068 | -0.023625 | -0.017655 | -0.012917 | -0.006375 |

| 2019-10-03 | 0.008495 | 0.009519 | 0.012105 | 0.006532 | -0.041542 |

| 2019-10-04 | 0.028032 | 0.017822 | 0.013502 | 0.008832 | -0.006866 |

| 2019-10-07 | 0.000220 | -0.001092 | -0.007240 | -0.004018 | 0.027179 |

| ... | ... | ... | ... | ... | ... |

| 2020-09-25 | 0.037516 | 0.011671 | 0.022787 | 0.024949 | 0.050414 |

| 2020-09-28 | 0.023869 | 0.013537 | 0.007795 | 0.025498 | 0.034026 |

| 2020-09-29 | -0.007568 | 0.003284 | -0.010409 | -0.009190 | -0.005057 |

| 2020-09-30 | 0.015076 | 0.000184 | 0.014812 | 0.001224 | 0.023719 |

| 2020-10-01 | 0.008462 | 0.013943 | 0.010127 | 0.023035 | 0.044638 |

254 rows × 5 columns

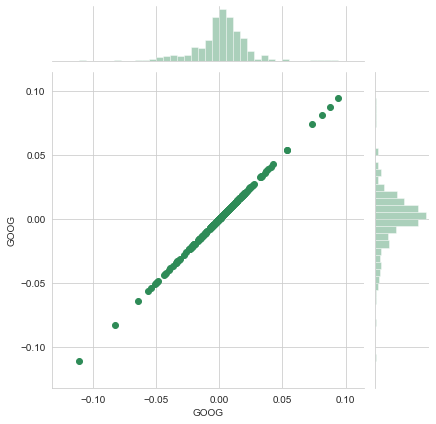

sns.jointplot("GOOG","GOOG",tech_rets, kind="scatter",color="seagreen")

<seaborn.axisgrid.JointGrid at 0x1ced4cf8448>

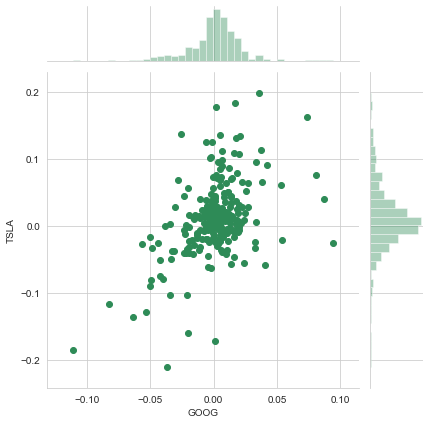

sns.jointplot("GOOG","TSLA",tech_rets, kind="scatter",color="seagreen")

<seaborn.axisgrid.JointGrid at 0x1ced5083d48>

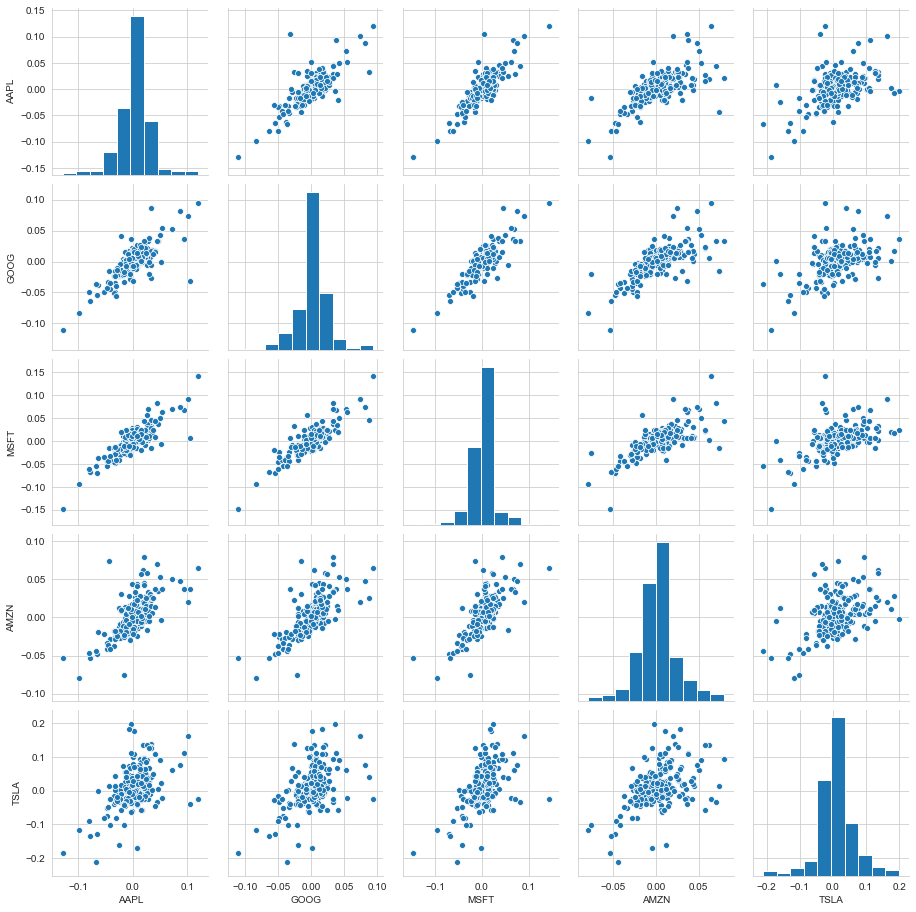

sns.pairplot(tech_rets.dropna())

<seaborn.axisgrid.PairGrid at 0x1ced5e57a88>

Above we can see all the relationships on daily returns between all the stocks. A quick glance shows an interesting correlation between Google and Amazon daily returns. It might be interesting to investigate that individual comaprison. While the simplicity of just calling sns.pairplot() is fantastic we can also use sns.PairGrid() for full control of the figure, including what kind of plots go in the diagonal, the upper triangle, and the lower triangle.

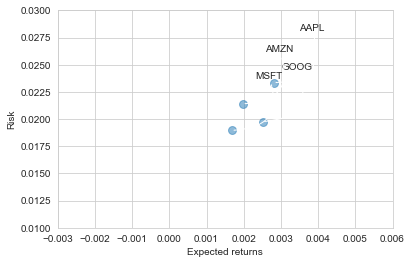

Section 3 - Risk Analysis

There are many ways we can quantify risk, one of the most basic ways using the information we’ve gathered on daily percentage returns is by comparing the expected return with the standard deviation of the daily returns.

#Let's start by defining a new DataFrame as a clenaed version of the oriignal tech_rets DataFrame

rets = tech_rets.dropna()

area = np.pi*20

plt.scatter(rets.mean(), rets.std(),alpha = 0.5,s =area)

#Set the x and y limits of the plot (optional, remove this if you don't see anything in your plot)

plt.ylim([0.01,0.025])

plt.xlim([-0.003,0.004])

#Set the plot axis titles

plt.xlabel('Expected returns')

plt.ylabel('Risk')

#Label the scatter plots

for label, x, y in zip(rets.columns, rets.mean(), rets.std()):

plt.annotate(

label,

xy = (x, y), xytext = (50, 50),

textcoords = 'offset points', ha = 'right', va = 'bottom',

arrowprops = dict(arrowstyle = '-', connectionstyle = 'arc3,rad=-0.3'))

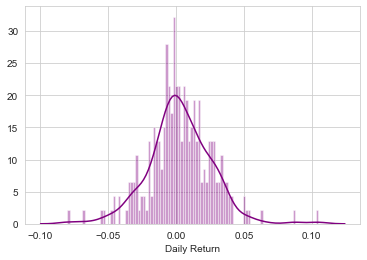

Value at Risk

Let’s go ahead and define a value at risk parameter for our stocks. We can treat value at risk as the amount of money we could expect to lose (aka putting at risk) for a given confidence interval. Theres several methods we can use for estimating a value at risk. Let’s go ahead and see some of them in action.

Value at risk using the “bootstrap” method

For this method we will calculate the empirical quantiles from a histogram of daily returns. For more information on quantiles, check out this link: http://en.wikipedia.org/wiki/Quantile

# Note the use of dropna() here, otherwise the NaN values can't be read by seaborn

sns.distplot(AAPL['Daily Return'].dropna(),bins=100,color='purple')

Now we can use quantile to get the risk value for the stock.

# The 0.05 empirical quantile of daily returns

rets['AAPL'].quantile(0.05)

-0.03377112705414851

The 0.05 empirical quantile of daily returns is at -0.033. That means that with 95% confidence, our worst daily loss will not exceed 3%. If we have a 1 million dollar investment, our one-day 5% VaR is 0.03 * 1,000,000 = $30,000.